Leading three Solar Industry Stocks on NSE

Introduction

One of the world’s most progressing markets in the solar energy sector is India as the government sets ambitious goals for renewable energy generation. The country’s installed solar capacity has risen to 84 cubic capacity. 27 GW from 2. 6 GW in 2014. Further, India ranks fifth in solar power installed capacities. With regard to these, the investors may be interested in identifying the newer and better solar stocks situated in India.

In this article, we will review the three most prominent solar energy stocks in India, covering their key characteristics, target investors, investment process, pros, cons, and other important information.

Comprehending Solar Energy Stocks in India

Solar energy is an eco-friendly power source with no harmful emissions and is increasingly used in both industrial and domestic applications. Many NSE-listed solar energy stocks reflect this trend.

Since 2011, the solar energy industry in India has seen remarkable growth, enticing investor interest. These stocks represent companies involved in manufacturing, selling, and installing solar panels, inverters, and related products. Leading Indian firms are actively engaged in producing and servicing solar energy solutions.

Purchasing top solar energy stocks in India allows investors to tap into the expanding renewable energy market. Experts predict that growing global demand for renewable energy will increase the value of Indian solar stocks. These encompass penny stocks and government-backed shares, both of which can offer substantial financial returns.

Impact of Union Budget for 2024-25 on Solar Energy Industry in India

Below are the key proposals from the Union Budget aimed at strengthening the solar industry in India.

-

Pradhan Mantri-Surya Ghar Muft Bijli Yojana: This scheme intends to introduce free electricity up to 300 units per month to one crore households via rooftop solar (RTS) installations. With over 1.28 crore registrations and 14 lakh applications, households could save Rs. 15,000-18,000 annually. The initiative also encourages electric vehicle charging, entrepreneurship, and job creation in solar panel manufacturing and maintenance.

-

Energy Infrastructure Enhancements: Sitharaman announced support for pump storage projects to ensure a continuous energy supply and a joint venture between NTPC and BHEL to establish an 800 MW supercritical thermal power plant.

-

Customs and Manufacturing Policies: The budget proposes expanding the list of exempted capital goods used in solar panel manufacturing while removing customs duty exemptions for solar glass and copper interconnects due to adequate domestic production capacity.

Solar energy plays a vital role in India’s plan to generate 500 GW of renewable energy by 2030, helping to reduce reliance on fossil fuels and combat climate change.

Leading Three Solar Industry Stocks to Invest in 2024

|

Solar Energy Stocks |

Market Cap (Cr) |

|

12,151.77 |

|

|

2,986.48 |

|

|

1,112.73 |

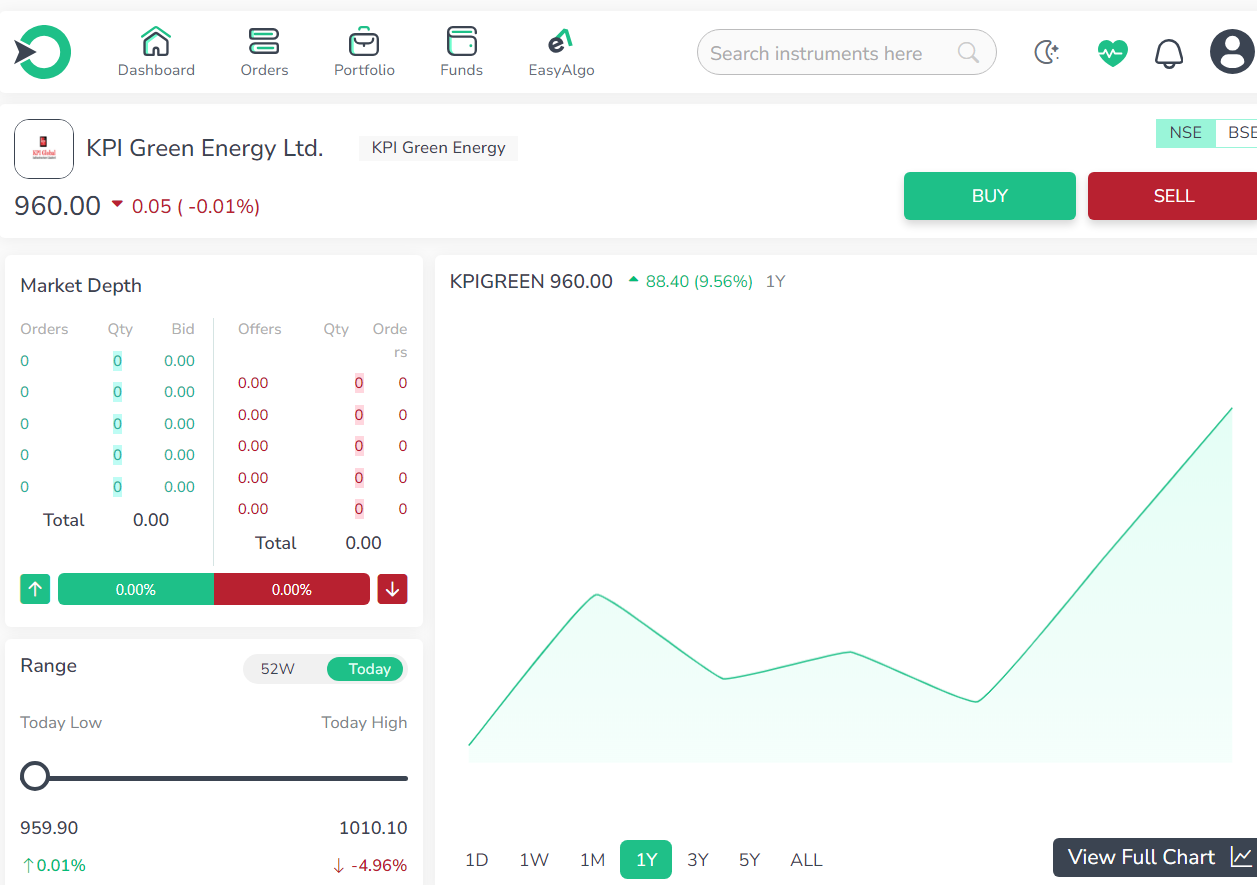

1. KPI Green Energy Ltd.

KPI Green Energy Limited operates under the Solarism brand in India, where it generates and sells solar power. The company develops, builds, owns, and manages solar power plants, acting as both an independent and captive power producer. Additionally, KPI Green Energy is involved in selling land parcels to third parties.

-

The price return for KPI Green Energy Ltd. has been average, showing no particularly exciting performance.

-

The valuation of KPI Green Energy Ltd. seems high, indicating that the stock might be overvalued compared to the market average.

-

The company exhibits strong financials and a robust growth story, highlighting its impressive growth over the years.

-

KPI Green Energy Ltd. demonstrates promising profitability and operational efficiency.

-

The current entry point for KPI Green Energy Ltd. is average, as the stock is not in the overbought zone.

In summary, KPI Green Energy Ltd. emerges as a major force in the solar energy sector. Although the stock’s average price return and high valuation hint at possible overvaluation, its impressive financial performance and strong growth trajectory highlight its industry leadership. With notable profitability and efficiency and a current entry point that isn’t overbought, KPI Green Energy Ltd. continues to be a top choice among leading solar stocks.

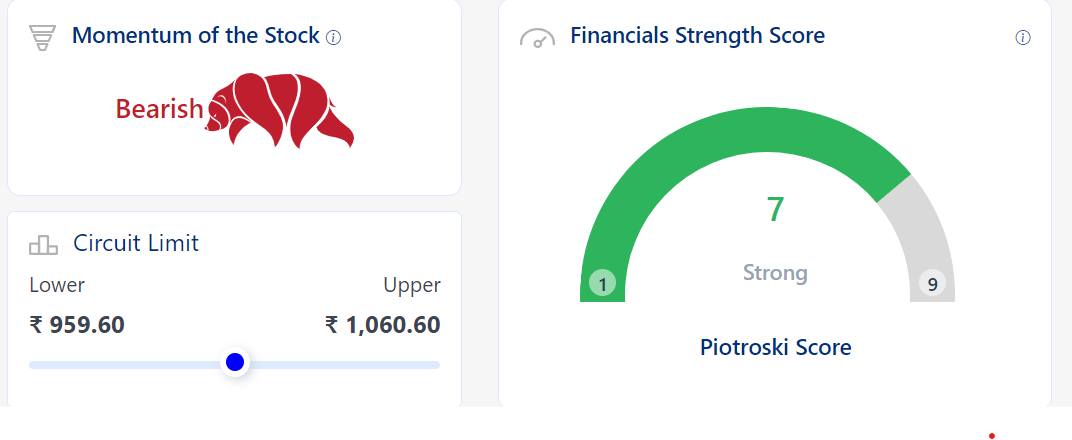

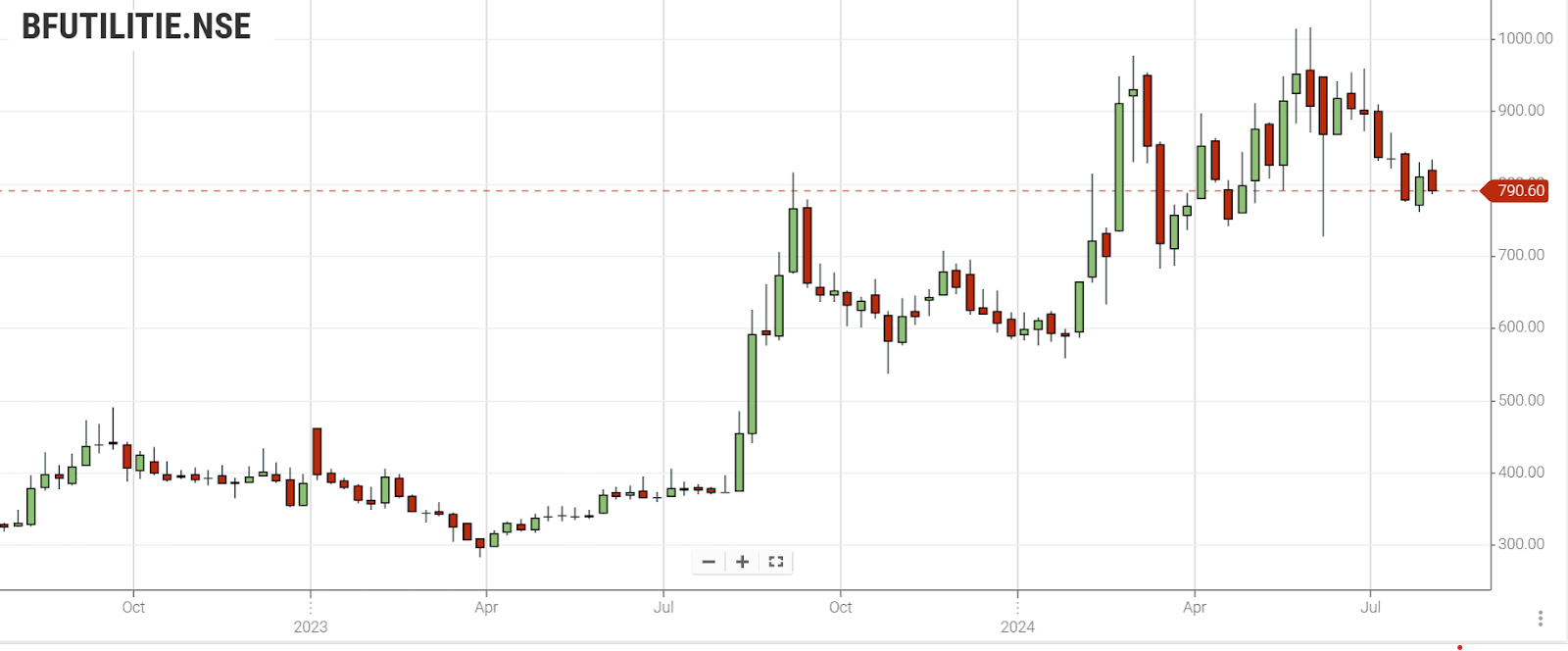

2. BF Utilities Ltd

BF Utilities Ltd. specializes in wind power generation and infrastructure development, operating through its two main segments: Infrastructure and Wind Energy.

-

The price return for BF Utilities Ltd. has been average, with no particularly exciting performance.

-

BF Utilities Ltd. seems to be highly valued, indicating that its stock may be priced above the market average.

-

The company is falling behind the market in terms of financial growth.

-

BF Utilities Ltd. shows strong signs of profitability and operational efficiency.

-

The current entry point for BF Utilities Ltd. is average; while the stock seems overpriced, it is not in the overbought zone.

Despite an average price return and high valuation, BF Utilities Ltd. demonstrates strong profitability and efficiency. While its growth lags behind the market, the company remains a prominent player among leading solar stocks.

3. Zodiac Energy Ltd

Zodiac Energy Limited specializes in installing power generation plants in India, offering a wide range of solar solutions. Their services include solar PV systems, water heaters, grid and off-grid systems, solar pumping solutions, building-integrated PV systems, and concentrated solar thermal systems for diverse applications like process steam, water desalination, and solar air-conditioning.

-

The price return for Zodiac Energy Ltd. has been average, with no particularly exciting performance.

-

The valuation of Zodiac Energy Ltd. appears high, indicating potential overvaluation compared to the market average.

-

The company is underperforming compared to the market in financial growth.

-

Profitability is average, neither particularly strong nor weak.

-

The current entry point for Zodiac Energy Ltd. is unfavorable, as the stock is in the overbought zone.

Despite average price returns and high valuation, Zodiac Energy Ltd. maintains average profitability and lagging growth. However, its comprehensive range of solar solutions positions it as a leading player among solar stocks.

Comparison of Leading Three Solar Industry Stocks to Invest in 2024

|

Company |

Revenue Growth (5 years) |

Net Income Growth (5 years) |

Market Share Change (5 years) |

|

KPI Green Energy Ltd. |

88.05% (vs. industry avg. 10.8%) |

78.55% (vs. industry avg. 17.52%) |

Increased from 0.2% to 2.86% |

|

BF Utilities Ltd. |

-40.3% (vs. industry avg. 10.8%) |

-23.45% (vs. industry avg. 17.52%) |

Decreased from 2.16% to 0.1% |

|

Zodiac Energy Ltd. |

28.36% (vs. industry avg. -6.34%) |

N/A |

Increased from 0.45% to 2% |

KPI Green Energy Ltd. leads in revenue and net income growth, significantly outperforming the industry averages and expanding its market share. In contrast, BF Utilities Ltd. has seen a decline in both revenue and net income, accompanied by a significant drop in market share. Zodiac Energy Ltd. shows strong revenue growth and an improved market share. Overall, KPI Green Energy Ltd. is the strongest performer among the three, showcasing robust growth and increasing market presence.

Price comparison:

Why Invest in Solar Energy Stocks?

Investing in India's solar energy stocks offers significant benefits due to the country's strategic initiatives and abundant resources. The Indian government supports the solar sector through policies like the National Action Plan on Climate Change, which aims to expand renewable energy capacity to 500 GW by 2030.

India's solar energy capacity grew dramatically from 1.60 GW in 2013 to over 84 GW by mid-2024, reflecting the industry's remarkable expansion. Technological developments are the driving force behind this expansion, as solar electricity becomes more economical and efficient when compared to fossil fuels. Along with fostering economic growth and employment creation, this industry supports global sustainability objectives.

India's geographical location offers a buffer against market instability and an abundance of sunshine, which supports the generation of solar energy. Although stocks in solar energy are well-positioned for growth, it is advised to speak with a financial expert before making an investment.

How to invest in solar energy stocks

Investing in India's solar energy stocks presents an enticing opportunity for investors. To begin, start by researching reputable solar companies with strong financial health and growth potential. Evaluate their performance by analyzing revenue trends, profitability, and future growth prospects. Understanding industry trends and government policies, such as incentives and subsidies, can help you identify companies poised for success.

Diversify your investments across different solar sectors to manage risk effectively. Open a Demat and trading account through a brokerage firm to hold and trade shares electronically. Once your account is set up, use your broker’s platform to buy solar energy stocks, and keep track of your investments and market developments to make informed decisions.

Who Should Invest in Listed Solar Companies in India

Investing in listed solar companies in India is ideal for long-term investors seeking capital appreciation, risk-tolerant individuals comfortable with market volatility, and those passionate about sustainable energy.

Factors to Consider Before Investing in Solar Industry Shares

Prior to investing in Indian solar industry shares, it’s crucial to evaluate government policies and incentives that might affect growth and profitability. Diversifying your portfolio with solar stocks can be beneficial, but be mindful of competition from traditional energy sources and global economic conditions that can affect stock performance.

Advantages of Investing in Solar Industry Shares

There are numerous benefits to investing in solar shares in India:

-

Long-Term Growth: The solar industry’s growth is fueled by rising demand for renewable energy and falling technology costs.

-

Diversifying with Solar Stocks: These stocks present a different risk-return profile compared to traditional energy stocks, enhancing portfolio diversification.

-

Environmental Impact: Solar energy supports a cleaner, more sustainable energy system and helps reduce greenhouse gas emissions.

-

High Return Potential: Growing solar company share prices offer the potential for significant returns as the industry continues to innovate.

Conclusion

India is poised to become a major player in solar energy, with strong growth potential for solar stocks. As the Indian government supports the sector, solar share prices are expected to rise. Fortunately, you don't need to track every solar stock individually. Enrich Money's trading platform allows you to invest in a curated portfolio of top solar companies listed in the stock market, providing easy access to this promising sector.

Frequently Asked Questions

-

How can I invest in solar energy stocks?

With the Enrich Money platform, you can easily invest in solar energy stocks through our user-friendly Orca app. Simply use the app to access a curated selection of solar stocks and ETFs, track their performance, and execute trades seamlessly.

-

Is now a good time to invest in solar energy stocks?

The solar sector is supported by various government initiatives such as solar parks and rooftop programs. Despite these opportunities, it's important to thoroughly research and evaluate risks, and seek advice from financial experts before investing in solar stocks.

-

Who should consider investing in solar energy stocks?

Solar energy stocks are a good option for those interested in renewable energy and potential growth. However, investors should perform due diligence and consult a financial advisor before making any investment decisions.

-

What is the comparison between solar energy stocks and other renewable energy investments?

Solar energy stocks often provide different risk and return profiles compared to other renewable energy investments like wind or hydropower. It’s important to compare these investments based on factors such as market potential, technological advancements, and government support.

Related Stocks

Check our ORCA app to analyze Solar stocks' performance:

Solar Industries India Ltd Share Price Today

Solar Industries India Technical Analysis

Solar Industries India Future Price

Solar Industries India Financial Statements

Solar Industries India Shareholding Pattern

Solar Industries India Latest Corporate News

Solar Industries India Stock/Company Overview

Related Stocks

Himadri Speciality Chemical Ltd.

Navin Fluorine International Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.